Prestige Consumer Healthcare (PBH)·Q3 2026 Earnings Summary

Prestige Consumer Healthcare Q3 FY26: Revenue Miss Overshadowed by Clear Eyes Recovery Progress

February 5, 2026 · by Fintool AI Agent

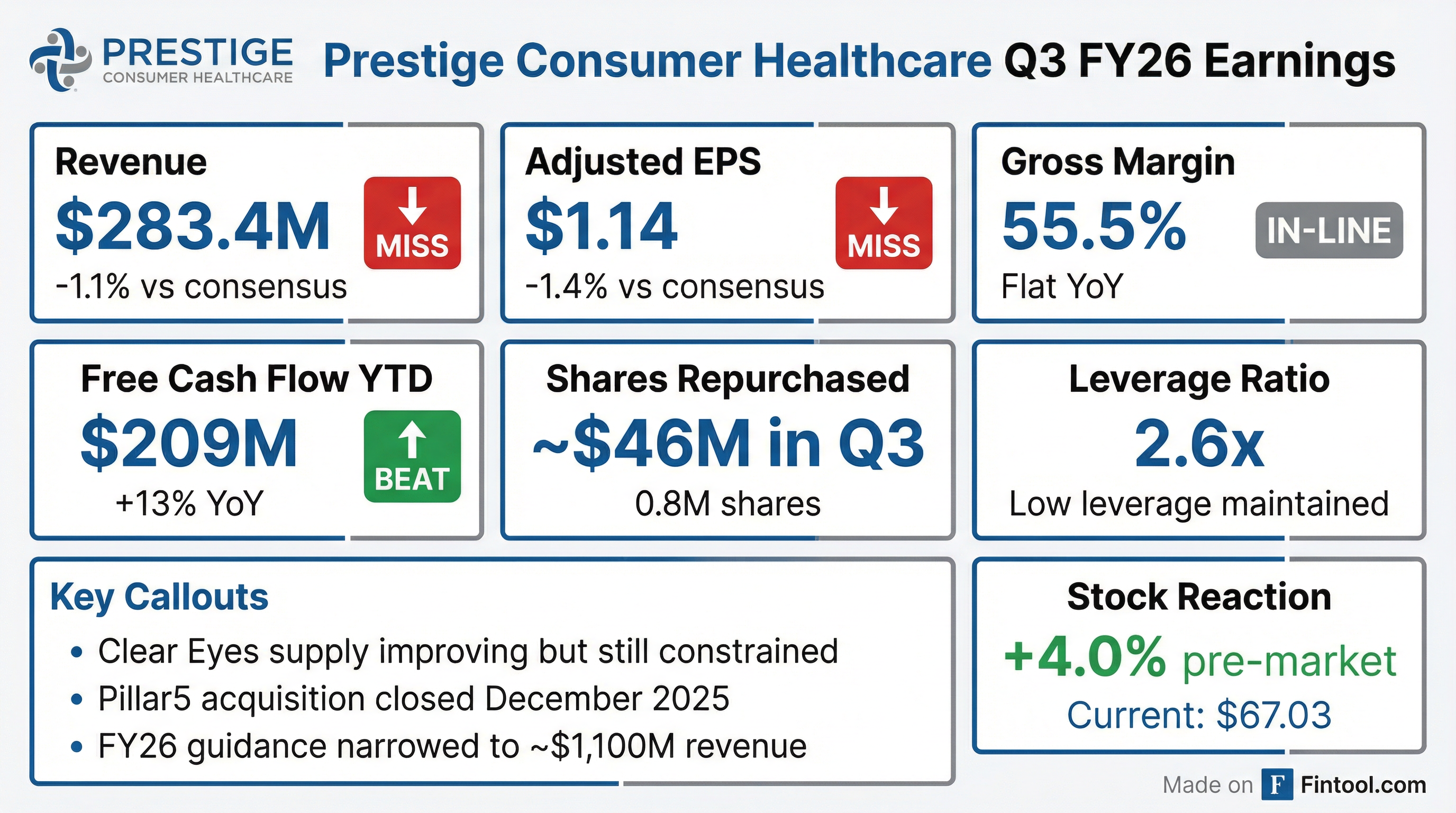

Prestige Consumer Healthcare (NYSE: PBH) reported Q3 FY2026 results that missed Street expectations on both revenue and earnings, but investors appear focused on the company's progress resolving its persistent Clear Eyes supply constraints. The stock traded up ~4% pre-market as management highlighted the successful December closing of the Pillar5 Pharma acquisition and sequential improvement in eye care shipments. On the earnings call, CEO Ron Lombardi emphasized that underlying consumption remains healthy and the revenue shortfall reflects retailer channel shifts rather than demand deterioration.

Did Prestige Consumer Healthcare Beat Earnings?

No — PBH missed on both revenue and EPS, though the misses were relatively modest:

*Values retrieved from S&P Global

The revenue decline of 2.4% YoY (2.2% organic) was primarily driven by lower Eye & Ear Care category sales due to the ongoing Clear Eyes supply constraints. However, management emphasized that revenue came in "ahead of outlook," suggesting internal expectations were even lower.

The adjusted EPS of $1.14 compared to $1.22 in the prior year quarter, with the decline reflecting lower sales and timing of expenses. Adjustments included a $10.3M supplier loan write-off and $0.5M in Pillar5 acquisition costs.

What Did Management Say About Clear Eyes?

The Clear Eyes supply issue has been the dominant narrative for PBH over the past several quarters. CEO Ron Lombardi provided a notably optimistic update:

"Clear Eyes supply improved sequentially for the second quarter in a row... As expected, we continued to make progress toward improving Clear Eyes supply, increasing sales sequentially and closing on the acquisition of Pillar5 in December."

Strategic actions executed:

- Added two additional 3rd party suppliers in Q1 and Q3 respectively

- Closed strategic acquisition of Pillar5 Pharma (eye care partner) on December 18, 2025

- Majority of Clear Eyes supply now sourced internally, enabling improved visibility

Calendar 2026 priorities:

- Invest to accelerate Pillar5 production capacity, particularly on new high-speed line

- Re-expand SKU assortment

- Gradually rebuild retailer and PBH safety stocks

- Reaccelerate distribution through supply confidence and robust marketing

How Did Segments Perform?

Both segments were impacted by eye care supply constraints. The International segment showed 4% growth excluding eye care constraints and foreign currency.

YTD Performance:

- Total Revenue: $807.1M vs $841.2M prior year (-4.1%)

- Organic Revenue: Down 3.9% excluding FX

- The YTD decline also reflects Q1 headwinds from accelerated order timing in Q4 of the prior year

What Changed From Last Quarter?

Key sequential improvements:

- Clear Eyes supply improved for the second consecutive quarter

- Pillar5 acquisition closed in December (was pending in Q2)

- Free cash flow generation remained strong

What Did Management Guide?

PBH narrowed its FY26 outlook to the low end of prior guidance:

Management cited the "continued challenging consumer environment" as the reason for narrowing to the low end, while maintaining strong free cash flow expectations.

Q4 expectations: Management anticipates improvement in Clear Eyes shipments sequentially in Q4 and expects earnings growth to reaccelerate as revenue improves.

How Strong Is Free Cash Flow?

Free cash flow remains a standout for PBH, up 13% YoY despite revenue headwinds:

The strong FCF conversion demonstrates the resilience of PBH's business model even during supply-constrained periods.

How Is Capital Being Allocated?

PBH has been actively returning capital to shareholders while maintaining strategic flexibility:

Share Repurchases:

- Q3 FY26: ~0.8M shares for ~$46M

- YTD FY26: ~2.3M shares for ~$156M (~5% of shares outstanding)

Balance Sheet:

- Net Debt: ~$1.0B as of December 31, 2025

- Leverage Ratio: 2.6x (covenant-defined)

- Long-term Debt: $1.034B

- Cash: $62.4M

Acquisition:

- Pillar5 Pharma closed December 2025 for ~$125.5M (net of cash acquired)

- Adds internal eye care production capacity

Management emphasized that low leverage "continues to enable capital allocation optionality" for pursuing M&A, share repurchases, and deleveraging.

How Did the Stock React?

The stock traded up approximately 4% pre-market following the earnings release, suggesting investors are looking through the near-term revenue and EPS miss to focus on:

- Clear Eyes recovery progress — sequential improvement for the second straight quarter

- Pillar5 integration — provides path to supply normalization

- Strong FCF — up 13% YoY despite revenue headwinds

- Share buybacks — $46M opportunistic repurchases in Q3

Valuation context:

- Current price: $67.03

- 52-week range: $57.25 - $90.04

- Market cap: ~$3.3B

The stock remains well off its 52-week high of $90.04, with the Clear Eyes supply overhang still weighing on valuation.

What Are the Key Risks?

Management flagged several risk factors in the forward-looking statements:

- Clear Eyes recovery execution — ability to rapidly increase supply from Pillar5 and other suppliers

- Consumer environment — continued challenging backdrop mentioned in guidance cut rationale

- Tariff exposure — evolving U.S. and international tariffs and trade actions cited as risk

- Integration risk — Pillar5 integration and transition expenses not fully quantified

- Inflation — ability to pass along rising costs without impacting sales

Q&A Highlights

On Channel Dynamics and Destocking (Rupesh Parikh, Oppenheimer):

When asked whether consumption is shifting to other retailers or if this is inventory destocking, CEO Ron Lombardi clarified:

"We're seeing a volatile environment, lots of things kind of distracting and impacting how consumers think about shopping. And what we're seeing is more of a continuation of a channel shift. So we're picking up the consumption based on where they end up purchasing the product."

Management confirmed underlying consumption trends remain healthy — the revenue shortfall is driven by retailer order pattern adjustments, not demand deterioration.

On Clear Eyes Restocking Timeline (Susan Anderson, Canaccord Genuity):

CFO Chris Sacco provided important context on the recovery timeline:

"It's going to ramp, right? It's not a switch that we turn on. So in terms of restocking, right, it's going to take us some time. We're going to be probably incurring this as we work through fiscal 2027."

Margins are expected to remain "relatively stable" as eye care supply normalizes — no meaningful margin impact expected.

On Capital Allocation Philosophy (Keith Davis, Jefferies):

CFO Chris Sacco explained the rationale behind aggressive share repurchases:

"It's math, right? We do the math, and we think we're getting a pretty good return for our shareholders by reinvesting in ourselves at this point... It comes secondary to M&A. And certainly, we don't impact the business in investing in our brands by doing it."

M&A remains the secondary priority after brand investment, with share repurchases opportunistically executed when returns are attractive.

On FY27 Outlook Preview (John Anderson, William Blair):

Management provided early color on fiscal 2027 setup:

"We continue to feel good about the performance of our business on an organic basis. And then secondly, we've talked about the expectation of continued increases in the Clear Eyes supply chain. So we'll provide more color and details for fiscal 2027 on the May call."

Category Performance Deep Dive

The transcript revealed important category-level dynamics beyond the segment reporting:

E-commerce highlight: Consumption grew over 10% in Q3, continuing strong trends from prior years.

Private label: Management sees no change in private label share dynamics — trusted brands remain preferred in OTC categories where consumers purchase infrequently.

Supplier Loan Write-Off Explained

The $10M supplier loan write-off was clarified as a distinct situation from Pillar5:

- A liquid mix and fill supplier approached PBH ~2 years ago with financial difficulties

- PBH extended ~$8M in secured financial assistance while transferring products to other suppliers

- Products were successfully transferred without meaningful supply disruption

- The supplier failed to complete a sale and shut down in December 2025

- One product (Debrox earwax removal) was moved to Lynchburg facility

CEO Lombardi emphasized this was "very different than the Pillar5 example" — ample alternative liquid mix and fill capacity exists in the market, unlike sterile eye care production.

What's Next?

Q4 FY26 Catalysts:

- Sequential improvement in Clear Eyes shipments expected

- Pillar5 production ramp-up, particularly new high-speed line

- SKU re-expansion and retailer stock rebuilding

FY27 Setup:

- Consensus expects revenue of $1.133B (+3.0% YoY)*

- Consensus expects EPS of $4.83 (+6.3% YoY)*

- Clear Eyes supply improvement expected to continue through FY27

*Values retrieved from S&P Global

The bull case hinges on Clear Eyes supply normalization driving revenue reacceleration, margin expansion from operating leverage, and continued disciplined capital allocation. Management expressed confidence in the "base business performance" organically, with Clear Eyes recovery providing incremental upside.